The Forgotten Fourth Function of Money

How Standard of Value/Contract in the Digital Era Debunks Austrian Monofunctionality Theory, Resulting Implications for Transient Monetary States, and Practical Aspects in light of Bitcoin Taro

Quick Housekeeping: This newsletter has changed its name from “Astigmatic” (always sort of hated that name) to “Heaviside”. The Heaviside function is sort of the integral of the Dirac Delta distribution, and this newsletter is sort of an integration of my tweets, which are now under the nym, Dirac Delta (@diracdel). Additionally, bitcoin’s price action, as a finite time singularity is inherently a hyperbolic function, and hyperbolic tangent is the smooth approximation for the Heaviside function. I had the first half of this written around 9 months ago, and might publish more frequently going forward.

The foundations of thinking as to the nature of money are insufficient to understand the present situation. Though various thinkers have put forth comprehensive treatises on money that represent a far more sophisticated understanding than most people have today, these documents, in their abstractions, have not gone far enough in contemplating the peculiar case of monetary goods as they have come to exist today under to the effects of fiat money. Moreover, the majority of concepts revolve around an equilibrium state and do not adequately cover key aspects of interregnums of de-monetization and monetization that a writer in the 19th century would not have a clue about since the possibilities for dynamic transitions away from unstable aberrations grows combinatorially (unstable situations can arise in any number of ways, and I’m not aware of anyone predicting the full scope of fiat & Bitcoin 100+ years ago, though in retrospect, the paths fiat monetization may take may not vary all that much).

Anyway, I have been able to tease out some of these combinations and map them to the original concepts of money as formulated in Jevon’s Money and The Mechanism of Exchange. Doing so reveals some interesting possibilities about the path Bitcoin may take as it eats away at the monetary premiums of all other goods/monies in existence.

The Functions of Money

Most Bitcoiners have had to explain to people that the medium of exchange aspect of money follows the store of value aspect (since in the initial stages when holders expect substantial appreciation, they will seek to exchange and rid themselves first of what they consider the lessor good (Gresham’s Law) — moreover, given that the value of bitcoin is still a mere two thirds of a tenth of a percent of the global wealth (~$500 trillion to a quadrillion), it is naturally impossible that it would be a significant medium of exchange regardless of its technological capacity for exchange). Only after a money becomes the dominant medium of exchange does it also then become the unit of account. With all three of these functions met by a single monetary good, one would thereby be entirely on such a standard. But there is no inherent requirement that the functions of money would be met entirely by a single good, as can be easily seen by a person that transacts in dollars and holds the bulk of their wealth in assets.

It turns out that the meeting of these three seemingly complete functions by a single good is different from the union of these functions being met across different objects, for there is a fourth emergent function that this lack of unity requires us to make explicit. This is the so-called standard of value, or more intuitively, standard for deferred payment or standard of contract, which stipulates the denomination of a transaction that is to occur at a future date. A transaction that will occur at a future date is rather different from one that merely might occur. Transactions that might occur are resolved by one’s store of value and the optionality to use some medium of exchange, with such transaction accounted for in, well, anything. A deterministic transaction on the other hand must occur under specific terms, and the full scope of optionality is removed. Most discussion of money has resolved around atomic, instantaneous transactions (exemplified by the consumer myopia), but in the course of business and life, there is often a need to remove uncertainty around what is to be received.

It is untenable for an operating business to engage in daily negotiations over pricing (or continuous negotiations for that matter), so instead, they agree to terms of delivery in advance, often with these terms locked-in with some number of repetitions going out into the future. This is integral to what is known in contract theory as relational contracts. The retail individual is familiar with such arrangements when it comes to payments for subscription services, payments for utilities, are the exchange of their labor via employment.

However, relational contracts compared to what we might call “spot contracts” (contracts in which offer, acceptance, consideration, and delivery all take place within a matter of instants, without any expectation on either side with respect to any possible future engagements) represent a far larger percent of economic activity for business actors than for individual actors. Herein may lie the root of the neglect for the critical function of money, and the error is no less foolish than the bitcoin skeptic who inquires as to the suitability of bitcoin for the purchase of the coffee — he who so readily sneered at the “lower tier” consumer level economic actor from the position of the saver now finds himself cornered in an anologous myopia of retail-tier thinking.

If a good perfectly satisfies the three functions, we can be confident it will also carry out the 4th, but it is not strictly necessary that that occur. To prove to ourselves that the standard for deferred payment is not in fact coupled to the first three, we can simply run through a couple counter-examples. Imagine two bitcoin maximalists*, one of whom lets say has inherited a house that he must rent out and is prohibited from selling (since why would a bitcoin maximalist hold real estate?). One bitcoin is the landlord and the other is the tenant. The lease terms are $1000 per month for a 1 year lease. Now, both parties hold their savings in bitcoin, but each transfers into dollars for a few hours to engage in a dollar transaction (both of our bitcoiners do not know their counterparty is a bitcoiner, for they both maintain excellent opsec). The tenant looks at their personal balance sheet every month in terms of the bitcoin they lost from this consumption, and the landlord looks at his balance sheet based on its increase in bitcoin. The only dollar accounting performed is that which is necessitated by law with regards to taxation. Then here is a situation where bitcoin performs the first three functions, but does not act as the standard of deferred payment. Consider further the exact same situation, but swap bitcoin and the dollar and you have another example. In fact, any two objects could be used: e.g. our tenants payments could require the delivery of the quantity of Logitech MX Master 2S mice that can be exchanged for 750 lbs of aluminum. As Jevons writes:

We must not suppose that the substance serving as a standard of value is really invariable in value, but merely that it is chosen as that measure by which the value of future payments is to be regulated. Bearing in mind that value is only the ratio of quantities exchanged, it is certain that no substance permanently bears exactly the same value relatively to another commodity; but it will, of course, be desirable to select as the standard of value that which appears likely to continue to exchange for many other commodities in nearly unchanged ratios.

…

A third function of money soon develops itself. Commerce cannot advance far before people begin to borrow and lend, and debts of various origin are contracted. It is in some cases usual, indeed, to restore the very same article which was borrowed, and in almost every case it would be possible to pay back in the same kind of commodity. If corn be borrowed, corn might be paid back, with interest in corn; but the lender will often not wish to have things returned to him at an uncertain time, when he does not much need them, or when their value is unusually low.

…

A borrower, too, may need several different kinds of articles, which he is not likely to obtain from one person; hence arises the convenience of borrowing and lending in one generally recognized commodity, of which the value varies little. Every person making a contract by which he will receive something at a future day, will prefer to secure the receipt of a commodity likely to be as valuable then as now. This commodity will usually be the current money, and it will thus come to perform the function of a standard of value.

*maximalism is not in fact real. I wrote most of this draft circa spring 2022, and did not feel compelled to come back to it since I understood the concepts perfectly well, I was focused on a bitcoin startup, and writing is largely a long tail activity. Anyway, there are simply those who understand bitcoin and those who do not, whereas the term “maximalist” rests upon the false & foolish, implied premise that there are “reasonable” positions that admit a monetary premium to any token or object other than bitcoin (for those who are not aware, it was also originally coined by shitcoiners as a slure) — those who feel rather impassioned about the importance of Bitcoin in the world may instead find it more apt to call themselves Bitcoin berserkers as I have.

The Anything Standard

Let’s take a look at the different objects we have available to carry out our various monetary needs/functions today. We have our unit of account and medium of exchange dominated by the dollar, and in practice, even those counting their wealth in bitcoin still tend to do much of their formal accounting in dollars. Store of value sees the dollar as a non-actor, though this is not the case for the poor, both in the US and globally, who are exposed to even faster devaluation of their currency. Gold used to be a medium of exchange and unit of account, but it was so lousy overall as a money, that fiat emerged, which led to the monetization of various goods which were harder to inflate than the fiat money after gold depegged, first through fractional reserves, and then entirely in 1971.

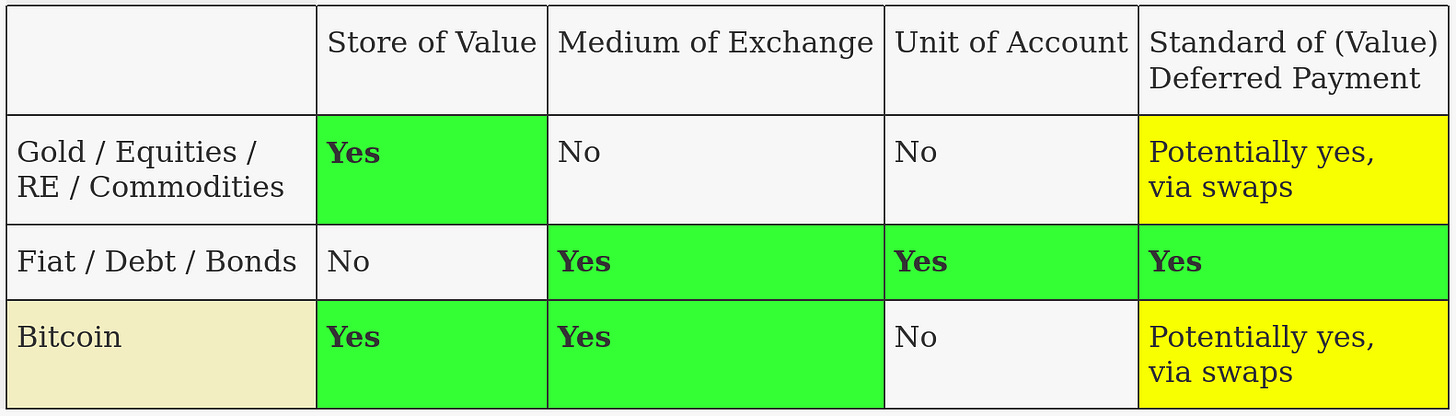

(Bitcoin is very nascent in the first two categories, so this chart isn’t great since the poor people using fiat as store of value is bigger than bitcoiners storing value in bitcoin, and as a medium of exchange smaller still (I would add more colors/nuance, but Idk what I did with the source code) — the more important thing to note is the significance of the two yellow components, especially the upper one, which can be thought of as an unexpected way to hack the fiat standard, orthogonal to bitcoin — it’s a bit like hypersonics in A2/AD — this may be the best way to knock down the front door of fiat seigniorage, massively smoothing the transition to bitcoin, which is always very hazy and volatile in the minds of most people as you approach the singularity).

This dual-monetary system is unique and prior to fiat, there was greater homogeneity across the functions in their use by different monetary goods, though no single good ever perfectly captured all four (from this we can get the notion that Bitcoin is the first ever actual money since it is the only thing that will ever accomplish this, though whether it is or isn’t then is merely inconsequential semantics — in general, the names we ascribe to things are of limited consequence, and the Bitcoin neophyte often confuse themselves with the mental baggage they bring around words such as currency, or medium-of-exchange… the same sort of useless drivel that most Americans can recite when hearing the term mitochondria, to which they ritualistically reply “it is the powerhouse of the cell” — a thought that does not come to my mind, for I was a rather poor student, especially in the subject of biology, yet I am the one pioneering what the FDA at gunpoint tells me I must not declare as as medical devices that massively improve mitochondrial health (along with my sincere disrespect of mitochondria-damaging seed oils) — hence, the subsidiaric statement that Bitcoin simply is, or that it is software, not money or any other such thing).

(I don’t exactly remember where I was going with this, so I’m just going to expand on some key points expanding the very short bullets I had in a way that perhaps is not narratively cohesive… probably still easier than following the concepts as I have previously laid them out across various tweet threads.)

Whatever wins as unit of account becomes the standard of deferred value because it is practically rather difficult to have these functions not coincide. The Austrian idea of the most liquid good being the money is actually a reflexive non-useful truism (like calories-in calories-out), that confuses the causality: the thing that has become the money finds itself having attained the greatest liquidity of all goods, not the other way around.

We can use software to decouple standard of deferred payment from unit of account. The Austrians made a major error in their thinking — they thought medium of exchange was everything because the latency in exchange meant that whichever good was used (imagine receiving a goat or gold coins as payment for a wagon) was the good you were likely stuck with for some amount of time — perhaps the markets you went to did not occur continuously, or they might have been geographically separated. This precluded total isolation of monetery functions.

Today, we have the internet, and in many situations a merchant can receive some monetary good and immediately swap into something else e.g. they may receive payment in bitcoin, and have it auto-convert into dollars, or a bitcoiner might have their bitcoin auto-convert into fiat just as they wish to purchase something. In this way, it becomes apparent that medium-of-exchange, and by association, Lightning, is being rather overhyped + overfunded by green investors (though I certainly like it in absolute terms).

From this it becomes easy to see the significance of swaps/futures as it pertains to standard of contract, whether for bitcoin or equities as I have previously mentioned. People do not hold bitcoin because bitcoin is the thing they want, but because of the perpetually recurring expectation that it is the thing another will want — in the absence of a sound monetary standard, software tools can allow deferred payment, and therefore trigger allocation of a balance sheet to a portfolio of assets that is reduced in dollar exposure. Curiously, a corporation faces the same non-ergodicity problem as the poor individual who holds cash.Hyperdollarization may lead to a protracted pre-hyperinflationary period where all of this becomes extremely relevant. Not only hyperdollarization, but the actual growth of real production, which may slow the demand for sound money (this will make sense to you if you have a solid understanding of how non-ergodicity differentially changes the value bitcoin offers to different economic actors).

Many bitcoiners have joined Peter Thiel (who is obviously not that smart as he confirmed most recently in his moronic talk praising the shitcoin [m]ETH at the Bitcoin Miami Conference for Simps and Shitcoiners, by Bitcoin Magazine) in the idiotic meme of the gReAT sTAGnAtioN, and I have made a website that runs the numbers in non-nonsense, real terms to disabuse people of this delusion, and this reality is rather important to keep in mind when considering the hard factors that will truly compel bitcoin adoption: https://civilizationmetrics.org I particularly enjoy the charts that start around 1971. The tl;dr is that these charts make it extremely obvious that though the industrial civilization was earlier, ~1950 was the real inflection point for human civilization and the more significant thing that happened around 1970 was we got off that inflection point, sort of like the percent growth in bitcoin cannot be expected to match now what it was in the first few years.

Dear reader, you may be a trillionaire in short order, do you not think it prudent to take a sound count of the objects of this planet rather than thinking in memes?

Here is what the first bit looks like:

Did William Jevons Predict Bitcoin in 1875?

The explanations of the different monetary functions come pretty early in Jevons’ book, and then it goes into a ton of boring minutiae around the particulars of coinage and details on the exact weights of various coins. I stopped reading it for months, but am glad I got back to it since one of the final chapters is particular interesting for the monetary theorist, and that is the concept of a multiple legal tender system evolving into a composite legal tender. People are familiar with the idea of a composite when it comes to a portfolio of savings, but choose to have a portfolio of nothing (dollars) to reduce volatility only when they are unable to have a sufficiently homogeneous composition of assets. A perfect index is of course achieved by any fixed accounting system, which only bitcoin can ever offer due to its unique ability to maintain its perfect monetary possibility. Jevons brought up the idea of using a superior index since he found gold to be excessively volatile.

That bitcoin is the ultimate solution has led people to ignore the fundamental monetary concepts and what using bitcoin actually does to the economic calculus that makes it useful. Of course, a perfect index of the planet is intractable, and built upon trusted 3rd parties, but that does not mean it is not now obvious that a number of intermediary approximations of sound money can start to be introduced. What will happen is that just like they moneyness leached into every asset from the saving function, we can actually make moneyness flow in through the other functions too. Bitcoiners might say “but won’t bitcoin absorb that monetary premium?” — yes, eventually, but the foundations of economic activity is the decisions of various actors, and you must consider what they actually want. Very few people today want bitcoin as indicated by the price, but they do certainly want things like equities. This is readily apparent by the 2.5x rise in P/E ratios of the S&P-500 over the past century or so.

Instead of fighting the monetary premium not being in the money, it is possible to do some judo and use fiat’s momentum against it: by increasing the monetary premium in equities, the dollar is weakened, while simultaneously fragilizing and volatilizing entire portfolios of what become increasingly correlated assets — the foundation of portfolio theory requires independence, but as the monetary premium rises, correlation increases further, and this breaks down the door for Bitcoin adoption.

Chapter XXV: A Tabular Standard of Value

At the outset it was observed that money, besides serving as a common denominator of value, and as a medium to facilitate exchange, was usually employed likewise as the standard of value, in terms of which contracts extending over long series of years are expressed. In letting land on long or perpetual leases, in lending money to governments, corporations, and railway companies, it is the general practice to make the interest and capital repayable in legal tender gold money. But there is abundance of evidence to prove that the value of gold has undergone extensive changes. Between 1789 and 1809, it fell in the ratio of 100 to 54, or by 46 per cent., as I have shown in a paper on the Variation of Prices since 1782, read to the London Statistical Society in June, 1865. From 1809 to 1849 it rose again in the extraordinary ratio of 100 to 245, or by 145 per cent., rendering government annuities and all fixed payments, extending over this period, almost two and a half times as valuable as they were in 1809. Since 1849 the value of gold has again fallen to the extent of at least 20 per cent.; and a careful study of the fluctuations of prices, as shown either in the Annual Reviews of Trade of the Economist newspaper, or in the paper referred to above, shows that fluctuations of from 10 to 25 per cent. occur in every credit cycle.

Corn Rents.

The question arises whether, having regard to these extreme changes in the values of the precious metals, it is desirable to employ them as the standard of value in long lasting contracts. We are forced to admit that the statesmen of Queen Elizabeth were far-seeing when they passed the Act which obliged the colleges of Oxford, Cambridge, and Eton, to lease their lands for corn rents. The result has been to make those colleges far richer than they would otherwise have been, the rents and endowments expressed in money having sunk to a fraction of their ancient value.

I believe that there is no legal impediment in the way of a landlord leasing his lands at present for a corn rent, or an iron, or coal, or any other rent. All that the law requires is that the contract shall be perfectly definite, and of exactly determinate meaning, so that the kind of commodity intended, and the quantity of that commodity, shall be exactly ascertainable. But the law, in defining legal tender money, provides against misapprehensions concerning money payments, whereas there is no security that mistakes and difficulties will not arise in taking other commodities as the matter of rents. Moreover any single commodity, such as corn or coal, undergoes considerable fluctuations from year to year, and as regards periods of ten or twenty years, might prove not to be so good a standard as silver or gold. Commodities which are comparatively steady in value on the average of long periods may be subject to great temporary variations of supply or demand.

A Multiple Legal Tender.

The question thus arises whether the progress of economical and statistical science might not enable us to devise some better standard of value. We have seen (pp. 136-143) that the so-called double standard system of money spreads the fluctuations of supply and demand of gold and silver over a larger area, and maintains both metals more unchanged in value than they would otherwise be. Can we not conceive a multiple legal tender, which would be still less liable to variation? We estimate the value of one hundred pounds by the quantities of corn, beef, potatoes, coal, timber, iron, tea, coffee, beer, and other principal commodities, which it will purchase from time to time. Might we not invent a legal tender note which should be convertible, not into any one single commodity, but into an aggregate of small quantities of various commodities, the quantity and quality of each being rigorously defined? Thus a hundred pound note, would give the owners a right to demand one quarter of good wheat, one ton of ordinary merchant bar iron, one hundred pounds weight of middling cotton, twenty pounds of sugar, five pounds of tea, and other articles sufficient to make up the value. All these commodities will, of course, fluctuate in their relative values, but if the holder of the note loses upon some, he will in all probability gain upon others, so that on the average his note will remain steady in purchasing power [emphasis mine]. Indeed, as the articles into which it is convertible are those needed for continual consumption, the purchasing power of the note must remain steady compared with that of gold or silver, which metals are employed only for a few special purposes.

In practice, such a legal tender currency would obviously be most inconvenient, since no one would wish to have a miscellaneous assortment of goods forced into his possession. He who wanted corn, would have to sell to other parties the iron, beef, and other things received along with it; gold, or other metallic money, would doubtless be used as the medium in these exchanges. This scheme would, therefore, resolve itself practically into that which has been long since brought forward under the title of the Tabular Standard of Value.

Composite currencies smooth the great transition

William Jevons’ concepts may finally viable, and they are more innately intuitive than Bitcoin since the notion of an index that is used purely for its peculiar property of uninflatability does not have a physical analog in the reptilian mind.

With the emergence of Taro (or some would argue RGB CMYK already enabled it). Bizarrely (or perhaps not so bizarrely), anyone with an interest in Bitcoin is likely exhausted of hearing boring people regurgitate the phrase “dollars on bitcoin” — I have even heard general partners of bitcoin venture capital firms state exactly this when I asked him what thesis he had around bitcoin adoption for the next decade and nothing more. Aside from what we might glean about humanity in general from this trend, I imagine the reader who is vaguely familiar with Taro has been primed to know that I am of course proposing the construction of composite currencies with Taro.

Quick primer on Taro: The idea of non-bitcoin being moved via the Bitcoin protocol may be a bit unintuitive, but that is only because of confusion around what various assets are. First, nothing can be held securely other than a cryptographic key since physical objects are seizable, and most of the fiat assets (equities, etc.) are not actually held directly — in fact, they cannot be held directly: oh, you want to “own your shares” and not have them controlled by DTCC? — well, you are going to run into the problem that the corporation you own shares in is arguably not something you actually own — a share can be considered nothing other than a special type of contract that entitles the holder to future cashflows. The corporation, in its personhood, could be said to be self-owned. In fact, the concept of a corporation as a “thing” is arguably itself an abstraction for a nexus of contracts among individuals.

So almost everything is really just a contract, a legal concept which arises from a type of promise among individuals with some extra promises of state violence sprinkled on top differentiating it from an ordinary promise. Now we are finally ready to consider what Taro is: it is a way to enter into contracts that have unlimited transferability on the claimant side, with the utility of bitcoin, which comprises the ability to send, receive, and audit. Bitcoin is simply humanity having figured out for the first time how to do proper accounting, and bitcoin is not money, but an accounting system that can be used however one wants. Like any contract, the issuer may end up breaching their contract, however, for the majority of the world that is not primarily in Bitcoin, counterparty risk is tolerable, and will continue to be tolerable to them until they hold all their monetary premium in bitcoin.

When discussing Bitcoin with people, it is apparent that most people are extremely foolish: this is a double-edged sword — on one hand, it slows adoption, on the other hand, we might be one clever thing away from massively accelerating adoption. It is clear people are incapable of understanding incredibly basic economic concepts, even if they are billionaires or manage billions: namely, they confuse the properties of an ensemble with the ensemble of properties of the constituent components e.g. they claim bitcoin is volatile while being oblivious to the fact that the Sharpe index of SPY (S&P-500) is worse than that of 90% SPY + 10% BTC over ~6 years if you select every 1 year interval shifting daily (i.e. you look at Jan 1 2016 through Jan 1 2017, then Jan 2, 2016 to Jan 2 2017, and so on). Usually, there is over-“sophisticated” modeling BS, but Silicon Valley VC’s are the excerps of inane quips such “dollars on LN is my thesis” without running any numbers or thinking things through. A composite coin enables the properties of an ensemble to be encapsulated and conceptualized in a single object, which can be used for savings, but more importantly, for legibly specifying future payments in contracts.

Anyway, you either get it by now or you do not, I will not belabor the point further: composite currencies that comprise some mix of dollars, equities, bitcoin (though not real estate — not fungible enough). The particulars of how they will be used, jurisdictions, legality, reducing counterparty risk to match that of ordinary fiat portfolios, tax implications, reducing tax liabilities by transferring forwards rather than spot assets, form vs substance and “true” asset owner are all fine to discuss and think about, but it is not a sufficiently interesting thing to consider in this newsletter. You might think the particulars matter — ok, well there are two options: 1) adoption of bitcoin will continue as it has, until some critical point is reached, and then remaining monetary functions will jump from 0 to 100 to match bitcoin’s fiat price, or 2) there will be gradual, dynamic shifts of monetary premium across different objects, and the use of various objects across functions will become fractionalized, smoothing the transition. Maybe non-technical people have poor intuition about what is ultimately a physics problem. Could I be wrong? Maybe, but one of these is obviously overwhelmingly more probable than the other. Just as my website Civilization Metrics shows, even under highly sub-optimal conditions, life finds a way.