8 Appendix III: Etiology of Technological Advancement

Unedited, as originally written when I was pitching Mach Capital.

Needed somewhere to park this since I let the web-builder lapse. Will use this newsletter as a long-form blog in case I ever write anything else. Don’t know what point I’m trying to make or what it will be about so I’m calling it astigmatic.

8.1 Science versus Engineering

If we are to capture some of the gains from the civilizational leaps technology brings forth, we must understand the morphology of its constituent elements. That is, we need to understand the different types of players in the world and how they interact to transfer information and eventually deploy technology into the world through commercial entities. Investing without this sort of unified model is certainly possible, but it results in limiting the scope to one of the subdomains, which may implement recent technology advancements at a particular strata in the market, but not disrupt the dynamics of the overall stack. This has worked quite successfully in software, but this narrow worldview approach (which incidentally results in less focused investments) will fail to deliver the same returns in physical domains. Software is unique in that it is far more capable in enabling a startup to scale to a $10b+ outcome without a technological breakthrough. The business implications of software startups is more nuanced, but by first generalizing the effects and impacts of science and engineering, it will be possible to describe the context in which software operates, from which we can go back and consider where the most 'software-like' opportunities can exist for physical systems, which this firm will capture.

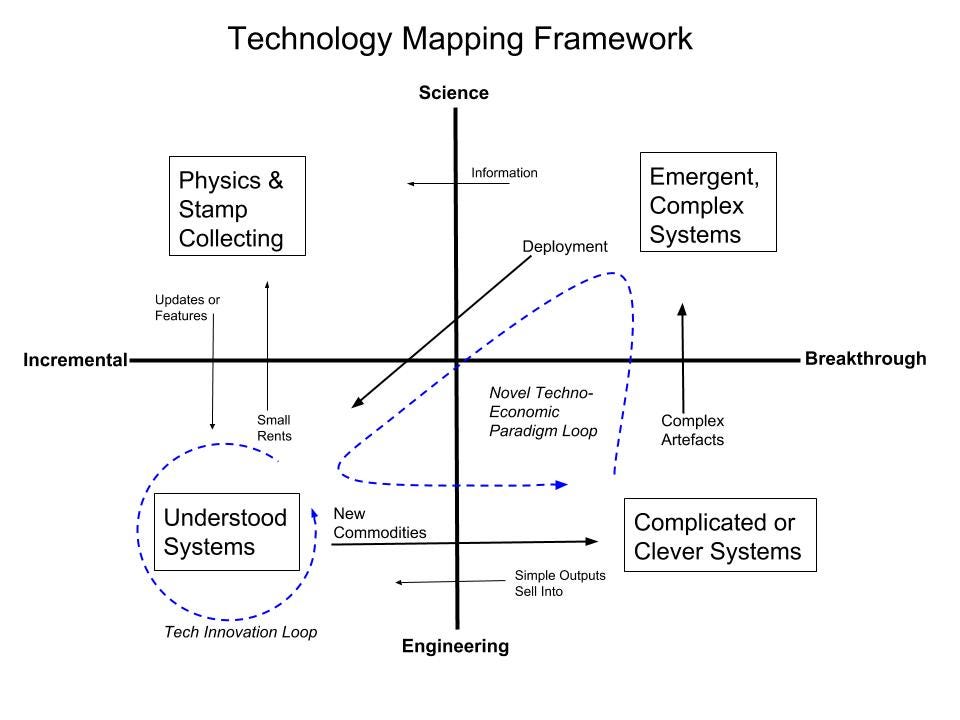

Starting with the idea that technology creates value, we can consider a comparison between science and engineering, further bisected by whether the advancement is a breakthrough or incremental, and then explain the key attributes and relationships among these core elements.

Figure 3 - Statistical mechanics of technological advancement.

QUADRANT I, SCIENTIFIC BREAKTHROUGHS Science is complex, meaning that there are multiple interacting variables that make attempts at prediction intractable. Outcomes are emergent and even the most significant ones do not necessarily result in value capture by a fast growth startup so there is not a reliable way to invest in startups with the intent of capturing scientific breakthroughs. Many VC funds have lost money because they become enamored in convoluted ideas here that are simply untenable from a business perspective for reasons inherent to the particular specialized market or technology. In fact, these sorts of ideas are often not scientific breakthroughs, but convoluted technology solutions with methods known to be problematic, but appear as new to them.

Scientific breakthroughs are often thought to come from scientists working in academia or research institutions, but the evidence does not support this notion (see this comparison by Nassim Taleb). A closer look at revolutionary scientific advancements shows that they more frequently arise unintentionally, often from non-experts that tinker in the field such that if they are lucky and prepared, they can capture a large upside. Scientific breakthrough then can be considered to be the artefacts of certain engineered systems. Tinkering in this context is not used pejoratively and instead reflects activities that can occur most effectively outside regimented scientific fields. They are not in contradiction with hard scientific principles, they are simply operating in areas where the scientific explanation behind what is happening has not yet caught up e.g. `impossible' flight of the bumblebee (see Tarpits and Antiflocking to get a better sense of what engineering in pre-scientific domains means).

Once the scientific breakthrough has occurred, the information of that breakthrough results in a flurry of interest where the scientists can fill in the details. In parallel, to the extent that the scientific breakthrough is understood, it provides fodder for deployment by enterprises in proportion to the extent that it becomes the new normal.

QUADRANT II, ENGINEERING BREAKTHROUGHS In engineering, systems are built out of commodity components that are known to work in a particular way, and they can be simple (clever) or complicated. When large systems are produced, they can be complicated without being complex. A complicated system has many pieces, but these pieces do not have unpredictable independent interactions, which is why it is possible to have an entire airplane, bridge, or building with exceedingly low risk of system failure. From a business perspective, clever simple systems can easily be replicated and eventually become commodity machines, although patents and first mover advantage might still allow for a successful business.

Most engineered systems built out of commodity components are not breakthroughs, so it requires significant daring and perhaps some irreverence to think that one can fashion something immensely useful with the machines and materials that are at our disposal. It is within this realm that the idolized inventor and entrepreneur resides. It is also associated with the failures of endeavours that promised wonders, but failed to materialize for a variety of reasons, including poor timing. For instance, it was roughly have a century between the Wright brothers' first flying machine, and the jet engine, which enabled a significant surge in passenger air travel. Machines that lead to complex outcomes such as aeronautics can have a very long path to market. Therefore, it is useful when the system in this quadrant also has a simpler output that can be sold immediately, perhaps without needing a comprehensive scientific understanding of the phenomenon. For instance, steam engines worked just fine even before we could model the thermodynamics of a heat engine.

A more complicated machine may be able to successfully distance itself from a commodity, but then it might seem at first glance too expensive for the risk, especially if there are unpredictable outcomes, without regard to whether it is possible to know beforehand the shape of the outcome space. Most VCs will take uncertainty they understand over ambiguity. Moreover, if this model is correct in describing the origins of technological value, there are simply not enough revolutionary startups in this quadrant to form a diversified portfolio. Plus, with the growth of VC it is incredibly difficult to justify an ability to spot these sparse startup opportunities so VCs optimize around several hundred million dollar outcomes, and only pay lip service to the possibility that they might hit a several hundred billion dollar outcome. It turns out that the startups that have those larger outcomes start here.

QUADRANT III, INCREMENTAL ENGINEERING This is the primary domain in which venture capital and all of the business world operates. There is no need for novel technical feats to start a world class business, especially when using software in a standard way. Understood systems in math and software are often called 'trivial, but trivial uses of software can have non-trivial outcomes. This category is also the place where one needs to ask whether the business is customer-driven or product-driven, whether the operations are lean or fat (Customer-Driven versus Product-Driven). These systems can be large and complicated where the novel element exists purely in the business model as is the case for practically all VC activity in space or the 'flying car' demos that come out on a near monthly basis. Defensibility arises from business dynamics, which may include the cost of building a complicated yet trivial system, and technological defensibility is a minor concern. Developments in this area result in new commodity building blocks that feed into quadrant II.

This domain requires excellent timing and insight since the gains are at the margins and the markets might be nascent. Software is nice in that it can capture a small margin in many places at once with low barriers to scaling out independent parallel instances --- it's not all network effects. This is the situation for the typical SaaS startup which is not so much building technology as building with technology rather than building technology, an important distinction. A product brings together a number of different elements and software is usually the key to fast enough scaling to obtain venture returns. When hardware exists in this category it must be simple so that the startup can accelerate fast enough or the margin will vanish, or become too small since there is no technological barrier. So the emergence of cheap hardware and software development becoming easier allows hardware startups to move quickly if they are not building very large physical systems.

In quadrant II, it is 0 to 1 territory so certain companies could find that their first billion dollars in revenue was no harder than their first million. With well understood technology, even when it's software backed, getting the first $10m in revenue might be far easier than the second $10m since fast-follow competitors quickly look to sieze margins (cue Bezos). Personally, I do not have the acumen to get an edge in this sort of environment. Perhaps some people are able to recognize patterns in entrepreneurs independently from the technology allowing them to make savvy investments while partially clueless about the technology and I applaud them, but it is simply beyond my abilities. There simply cannot be more value in (back) filling in the gaps of jobs that need to be done when doing so is trivial compared to startups that directly shift technological capabilities so there is no room for error (Understanding Is A Poor Substitute For Convexity (Antifragility)).

QUADRANT IV, INCREMENTAL SCIENCE This is the actual realm of academia and institutionalized science. It is excellent at answering questions when it is possible to identify the relevant question and have it be well-posed, which is not so easy most of the time. Outcomes in this space do not typically make for good startups. Physics and stamp-collecting are the two major classes of science according to Ernest Rutherford. It was likely said partially in jest, but is an important kernel of truth that is useful for understanding this model. Physics is the most rigorous of sciences and is able arrive at laws and facts with a fundamentally mathematical basis, whereas other fields work around models that are wrong to varying degrees. Fields such as economics, social sciences, or even many areas of medicine with its bad statistics and inability to replicate findings are not really scientific. They are either proto-scientific or pseudo-scientific depending on whether you want to be charitable or cynical --- if you want to be lazy, which may be a more efficient heuristic for the individual, pretending that scientific expertise is a real thing in all these areas might work out. Astrology never hurt anyone either as far as I'm aware. The stamp collecting bit refers to the idea that other scientific fields such as chemistry and biology are more about classification/categorization since it is harder to develop rigorous models baked in physics because the complexity at larger scales quickly becomes intractable, and eventually, even observe in a reliable way.

It is now possible to apply physics more broadly, and this usually involves explaining things that exist in the real world, but the things being explained do not always need to be explained in order to use them, as mentioned previously. Occasionally, scientists stumble upon some improvement, which might be strictly better than the alternative, but this will not usually result in a startup worth investing in. For instance, maybe a scientist makes a de-icing coating for planes --- if they had a few hundred billion dollars at their disposal perhaps they could replicate a plane company such as Boeing with the addition of their coating, and if all else were equal, they could win. Needless to say, these sorts of things don't happen. A much larger improvement is necessary so what usually ends up happening is a licensing deal if the value is worth the switching cost.

Furthermore, the scientists frequently get ahead of everyone else and start explaining all sorts of phenomenon in stamp-collecting style, which adds no fundamental value to physics, and may be entirely useless to industry. Just in time manufacturing is the most efficient system and that principle applies here as well so this activity is arguably an economic waste. The extent to which this waste exists is the extent to which there is a mistrust of science in society. The extent to which scientists do not want to admit this and instead seek to elevate their status is the extent to which their many valid contributions will go unappreciated, and perhaps this pattern is at the root of many problems in the world. What matters now is that for the sake of this fund, the scientists do not pose a threat. In fact, they actively support us.

8.2 Mapping the Big 7

Compared to the 'big 5', the big 7 drops Facebook and adds Intel, Oracle, and Cisco, which "only" have market caps around $200b (so only 20th century companies, Google being the youngest). All of these companies have their roots in quadrant II and took very little venture capital funding. The progression of 'tech' that started half a century ago can be traced through these companies.

INTEL used available semiconductor materials, lithography and etching techniques, along with knowledge of transistors to build chips with many transistors. This lead to complex problems in solid state physics and later electronic design automation as predicting the functionality of large numbers of tightly packed logic gates became intractable without software. Chips became an ubiquitous component at the center of computation machines.

APPLE started with available electronic components (including chips), and combined those with a keyboard, monitor, and the graphical user interfaces they learned about at Xerox PARC, which they madee further accessible to less tech savy users by inventing the mouse. As research into human computer interfaces progressed, these PCs became easily available, but they were still not widely used. The iPhone matches this pattern as well.

MICROSOFT leveraged the ability to program with PCs and came up with the clever idea of including Office in an operating system. This lead to complexity in business since it made these machines far more useful for standard business operations, and using computers became necessary for enterprises.

ORACLE started with CIA funding to develop databases, an abstraction that is quite useful for manipulating large amounts of data. Large amounts of data are now also integral to machine learning, which is now easily available and used widely.

CISCO figured out that combining the available computers with various communication technologies was quite useful, and the resultant local networks of computing systems were eventually followed by the internet.

AMAZON developed e-commerce due to the availability of PCs and the internet, and e-commerce is now an easy area to launch a startup.

GOOGLE started with applied math and found out that the Perron-Fobenius eigenvector of the web graph (aka Pagerank) was vastly superior to existing search engines.

All of these companies solved hard problems with tools available to everyone, and by doing so greatly increased surplus value in areas that were previously commodities. They were able to grow quickly and retain a large margin on surplus value through a combination of using software to scale and the fact that there was societal intransigence in the adoption process as these companies passed through the highly ambiguous quadrant I (e.g. no one would buy Google for $1m!). Those commodity areas that became centralized by these companies are more or less fundamental Jobs to be Done are as follows:

Intel centralizes computation, which was previously done by individuals with calculators or pen and paper.

Microsoft centralized the work of the middle class in the 20th century, which previously was done with paper.

Oracle and Cisco further centralized this sort of work, attacking the problem from a different angle.

Amazon centralized commerce.

Google centralized information.

Apple's largest uptick with the iPhone represent the centralization of ones' life through human interaction, which were previously done with simpler extension of the basic senses.

If we look further back in human history, we can think about the shift from gathering fruit to hunting Mammoth, or the shift from wood and a local blacksmith to blast furnaces. Centralization is Efficient!

8.3 Value as Efficiently Embodied Energy

The idea of efficiency is not by coincidence, but is inextricably tied to the fundamental nature of value creation itself. All value starts as energy and the world we live in exists as a transformation of energy. It is not philosophical. At first, we bashed various objects that we could easily grab until we figured out how to start fires that gave off energy, with which we were able to cook our meat, reduce our chewing time, and grow much larger brains leading to modern civilization (the quadrant II --> I --> III cycle is fractal). Our material world has embodied energy everywhere. The processes to fabricate raw materials involve chemical reactions so they can be computed accurately, but energy is used to implement these reactions through human technology so to know the true embodied energy of a piece of steel, we need to know the caloric value of the steak that the steelworker used in its production, which adds up if you include the critical aspect of technology development time (even advancements in sophisticated research or software that appears to use little energy exist within the incredibly costly infrastructure and time necessary to educate an expert). Since most technologies in the world are hierarchical compositions, it becomes very difficult to track the total energy needed to make a smartphone for instance since we would need to have a perfect model of the development of technology --- as impossible as perfectly predicting the weather due to the butterfly effect. However, relative changes within certain subdomains can be modeled similarily to how a local forecast can be right some of the time.

Luckily, economic activity in general can be mapped directly to the laws of thermodynamics and all the principles and relationships hold. However, the economic model that preserves that mapping is imperfect so this cannot provide all the information to make an investment decision. In the same way that life itself can be considered with a basis in thermodynamics, a firm can be thought of as a sort of heat engine (Minimum Viable Super-Organism) where technologies deployed are analogous to the thermodynamic cycle being implemented. This notion may seem impractical, but it yields the following proposition: the general trend of impactful technologies and firms is to increase efficiency and this leads to inexorable economic growth due to Jevons Paradox (this augmenting of useful energy, the area in which humans truly dominate, is called negentropy i.e. negative entropy --- we build/create complex structures and orderly systems out of pure light!). Jevons paradox states that total consumption rises when efficiency increases as it relates to energy, and we know that it is precisely the same for economic costs and total economic value in the system. Recently started reading Energy and Civilization and The Nature of Technology, which I suspect have a similar line of reasoning in combination. Addendum, finished the 2nd one and it lines up very well with my thinking --- either we both happpened to be wrong in precisely the same way, or this is correct. This is not a philosophical exercise. Being correct is valuable in business and investing.

8.3.1 The Non-Triviality of Trivial Systems

We can use this understanding of economic value and costs as embody energy in order to make better investment decisions, globally. This is not about the question of which particular company to invest in, which is where most venture capitalists focus, but in which subdomain to invest. When VCs say they are thesis driven they usually mean that they want to stake out a niche within quadrant III of understood technologies, not that they are deeply evaluating macro-trends. How can this claim be verified?--it simply requires considering whether there is greater variability within a firm or between firms. In other words, we can say that VC firms are not thesis-driven, but theme-driven, and maximize diversity within those themes since they are looking to minimize their own risk. Since LPs can diversify among VC funds, which are themselves an alternative asset, the onus should be on the GP to be as focused as they want their portfolio companies to be, personal risk aside. This is not typical, although part of the industry seems to be moving in this direction (e.g. Andreeseen Horowitz's latest funds) so the average company in two firms are usually more similar than the average two firms within either portfolio. For now, and perhaps for the forseeable future, the VC asset class overall has sufficiently high returns that this is not a problem, and this is largely due to the unreasonable effectiveness and value of software as applied in 'trivial' use cases.

WHY SOFTWARE EATS THE WORLD Technology is fractal and builds upon itself compositionally. In the physical world, machines are required at every level, but once software is running, more software can be built on top of it. This collapses the cost of developing with understood systems and pushes them into a domain where they can have a significant impact without the arduousness of advancing physical systems. Facebook is the prime example, which is why it was previously left out when considering the other very large tech companies. Today, Facebook has all sorts of hard software problems it works on, but initially it was a simple website that anyone could build, including a smart undergrad who happened to build it. The same is true of the most successful SaaS companies today or apps such as Uber and AirBnB. With those systems the complex outcomes happen at the social layer, similarly to how the automobile caused a social shift in the organization of cities. This does not mean anyone will be successful with this approach as the business risk and challenges there are orders of magnitude higher.

From the energy perspective, software is used to manipulate information in the most direct way possible, and from a fundamental physics perspective, energy and information can be seen as similar if not equivalent. Unlike physical systems that have to transform energy at multiple embodied levels, amplifying cost, software is mostly built on other software, allowing costs to be maximally reduced. The only downside is that the method by which the surplus value is captured is often indirect, and will not hold up for more than a couple years or decades. For instance, after a shift to a voice-first world, Amazon might successfully collapse the revenue streams of Facebook and Google. Amazon also has a pattern of crushing the sort of SaaS companies VCs like to invest in --- they're simply such an easy target.

An interesting result of this view of software as acceleration in the technology mapping framework, is that it models the singularity. Definition: as the time to go through the techno-economic-paradigm loop collapses to zero, the singularity occurs. This allows shifting the singularity question into one of maximal rates of advancement rather than a static definition of computing requirements, or questions of what AI is. We could use this definition of the singularity to create a backwards definition of AI (assuming AI is a prerequisite for the singularity) that AI is that which can effectively continue the acceleration of negentropy consumption in the absence of biological humans. Before the singularity, the relevant economic question is whether the advances in software will create more territory that can be explored faster than it becomes easier to compete for the existing territory. To the extent that there is uncertainty in the answer to that question, Mach Capital offers better risk adjusted returns than the typical VC firm.

[I’m usually too lazy to write longform stuff. More active on Twitter - @mchapiro]

It's astonishing that originally Google's founders wanted it to be not for profit, but rather a public utility type of system.